Business

The Ever-Changing Landscape of Venture Capital: A Decade of Transformation

courtesy of bothsidesofthetable.com

courtesy of bothsidesofthetable.com

Introduction: The Disruptive Powers of Technology and the Post-Pandemic World

The world is experiencing a rapid acceleration of technology across various industries and consumer applications. As society adapts to a new post-pandemic normal, the loosening of federal monetary policies, particularly in the US, has led to an influx of dollars into the venture capital ecosystems at every stage of financing. While these trends present global opportunities, they also bring significant challenges, such as the use of technology solutions by authoritarians to monitor and control populations and the potential for economic chaos through demagoguery. Furthermore, we live in a world that is "Hot, Flat & Crowded," as Thomas Friedman eloquently described it.

The Overvaluation Question: Are We in a Bubble?

One of the most commonly asked questions about venture capital and technology markets is whether they are overvalued. The answer, in short, is yes. Valuations are being pushed to absurd levels, and many of these valuations and companies won't hold in the long term. However, great venture capitalists understand that they must hold conflicting ideas in their heads. While they may be overpaying for every investment and valuations may not be rational, the biggest winners will ultimately be worth much more than the prices paid for them. This phenomenon has been observed with companies like Discord, Stripe, Slack, Airbnb, and Zoom, which have achieved unprecedented scaling and growth.

A Decade of Transformation: How the Venture Capital Landscape Has Evolved

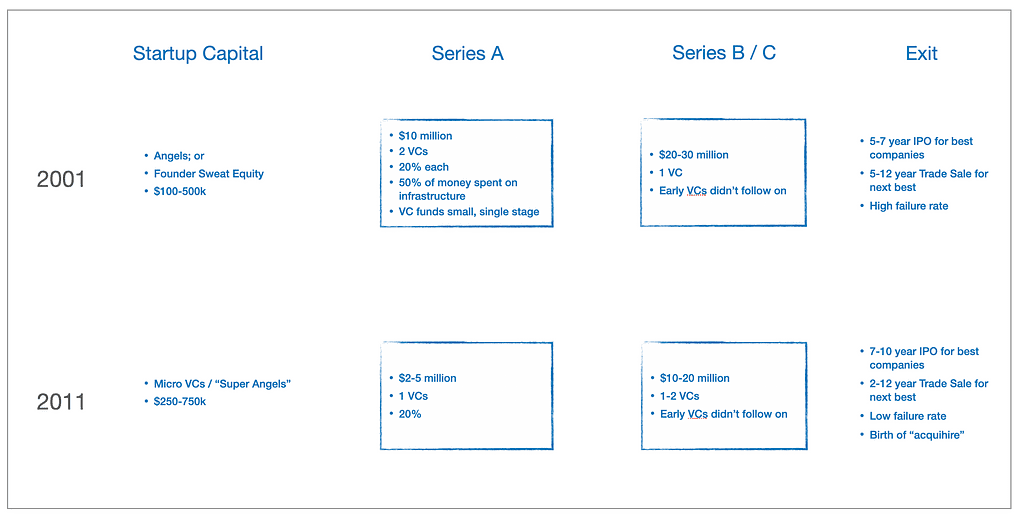

Ten years ago, we wrote about the changes to the venture capital ecosystem, providing a primer on how we arrived at 2011, a decade after the dot-com boom of Web 1.0. At that time, cloud computing, spearheaded by Amazon Web Services, played a significant role in transforming the landscape. The period between 2001 and 2011 saw the emergence of a healthy micro-VC market, shifting from entrepreneurs largely bootstrapping themselves to securing early-stage funding. IPOs also transitioned from quick exits to slower processes, with billion-dollar outcomes earning the moniker of "unicorns."

Fast forward to today, and the market would be barely recognizable to someone from 2011. Venture capital firms now focus on "Day 0" startups, which may not even exist yet. Founders with high potential often start with substantial funding, and the traditional image of two founders in a garage has become less prevalent. Seed rounds have become the new "A" rounds, and pre-seed rounds have emerged as a narrower segment. Seed rounds now range from $3-5 million, while pre-seed rounds involve raising $1-3 million on a SAFE note without giving out board seats.

Furthermore, the best A-rounds today are significantly larger than before, with valuations of $60-80 million or more. The timeline for exits has also expanded, with many of the best outcomes occurring 12-14 years from inception due to the availability of private-market capital and robust secondary markets. These changes have led to a shift in the role of early-stage investors, who now need to commit earlier and demonstrate strong conviction in the team and opportunity. Seed investments make up around 70% of early-stage investments, with pre-seed accounting for the remaining 30%.

A Unique Approach: The Barbell Strategy

At Upfront Ventures, we have adopted a "barbell strategy" that focuses on early-stage and growth-stage investing. We believe that to drive outsized returns, we must develop an edge by building relationships and knowledge in areas where we have informational advantages. While we continue to invest in Greater Los Angeles, which has produced successful companies like Snap, Tinder, and SpaceX, we also organize ourselves around practice areas such as SaaS, Cyber Security, FinTech, and more. This approach allows us to leverage our expertise and make informed investment decisions.

Looking ahead, the future of venture capital is likely to be shaped by the further deployment of technology into various industries and government sectors. This will lead to increased investment and fuel innovation and value creation. While we cannot predict the future with certainty, these trends indicate the ongoing transformation and evolution of the venture capital landscape.

courtesy of bothsidesofthetable.com

courtesy of bothsidesofthetable.com

Hello there! I’m Jeremy Ramirez, your go-to guy for all things content marketing and social media at NewsScroller. Currently residing in the vibrant city of Omaha, NE, I’m living my dream of combining my passion for journalism with the dynamic world of digital media.

I’m a proud graduate of the University of Nebraska, where I honed my skills and earned a degree in journalism. My college days were filled with endless learning, coffee-fueled study sessions, and the excitement of discovering the power of storytelling.

Post-graduation, I found my calling at NewsScroller, where I currently lead a team of creative minds in shaping compelling content strategies. Every day is a new adventure here – crafting stories, analyzing trends, and engaging with our vibrant online community.

When I’m not immersed in the digital world, you’ll find me cherishing moments with my amazing wife and our two energetic boys. Our family is completed by Dagwood, our adorable Pug, who always brings smiles to our faces.

Traveling is my escape and inspiration. I love exploring new cultures, tasting local cuisines, and capturing memories through my lens. As a speaker at social media events, I enjoy sharing insights and learning from fellow enthusiasts.

Curious about content marketing strategies or the latest social media trends? Or maybe you want to exchange travel stories? Feel free to reach out. I’m always up for a chat and eager to connect with like-minded individuals. Let’s navigate the exciting world of digital media together!

Want to know more or say hi? Drop me a message anytime!